“As automakers transform, so must suppliers” [1]. With the automotive industry shifting towards electrification, clean mobility, and digitalization, strict governmental regulations and competitive pressure have compelled automotive suppliers to find new and creative ways to accelerate and refine their engineering performance in order to catch up with the planned visions for the market and still win and maintain deals with OEM customers.

With the EU’s commitment to scale up hydrogen mobility by 2030 [2] and companies across the pond launching their mass production of their 10-years-in-the-making hydrogen fuel cells [3], the automotive market keeps experiencing increasing demands and competition. A similar scenario can be seen with electric vehicles. And even though the US government is set to ease its stringent 2030 requirements for EV sales following recent urges from automakers and UAW (United Auto Workers) [4], the pressure on automotive suppliers persists. Timelines for RFQ/RFP responses, engineering projects, and reaching certification milestones continue to shrink, and lead times have become a critical point of concern. This has resulted in cumulative pressure on suppliers to transform their engineering innovation and efficiency now more than ever. Could there be a way for automotive suppliers to circumvent this pressure and meet the increasing demands and goals? Some seem to have found an effective one.

Addressing Bottlenecks and Shrinking Timelines

The automotive sector is undergoing a seismic shift with the advent of technology trends like electrification and hydrogen energy, leading to fundamental changes in manufacturing processes and supply chains. The trend towards lower volume vehicle programs with shorter runtimes intensifies the pressure on suppliers to deliver quickly and accurately. Added to this is the ever-increasing demand from OEMs for groundbreaking innovations, further complicating the supplier landscape. As a result, bottlenecks have begun surfacing at different stages, and automotive suppliers are striving to find solutions that can help them enhance their engineering performance and cope with shrinking timelines.

One critical bottleneck hampering suppliers’ ability to keep pace with shorter timeframes and complex requirements of component development is their reliance on traditional, centralized CAE simulation deploys, which causes waiting times of up to several months to provide validation results. We’ve heard from numerous automotive suppliers that the RFQ response timelines given by OEMs continue to shrink – depending on the OEM and component down to two weeks. As timelines continue to shrink, such lengthy processes are likely to lead to missed deadlines and potentially lost opportunities. This is where simulation lead time becomes a critical factor, and reducing it can help meet demands efficiently and effectively.

Simulation Lead Time: The Latent Bottleneck

While engineering simulation enables swift, risk-free testing and optimization, traditional centralized simulation approaches, predominantly handled by simulation engineers, often constrain the number of design iterations possible within a given timeframe. Not only does this limitation delay validation results, but it also inhibits the engineers’ ability to explore a wide range of design variants and hampers the quality of responses to RFQs.

Reducing product development time, ensuring first-time accurate products, and offering high-value, cost-effective solutions with cutting-edge technology are paramount for automotive suppliers. Simulation workflows play a vital role in achieving these goals, but only when they can adapt to changing timelines and complexities. This is where bottlenecks begin to surface. In fact, several engineering managers have pinpointed that simulation lead time is one of the most critical bottlenecks they have.

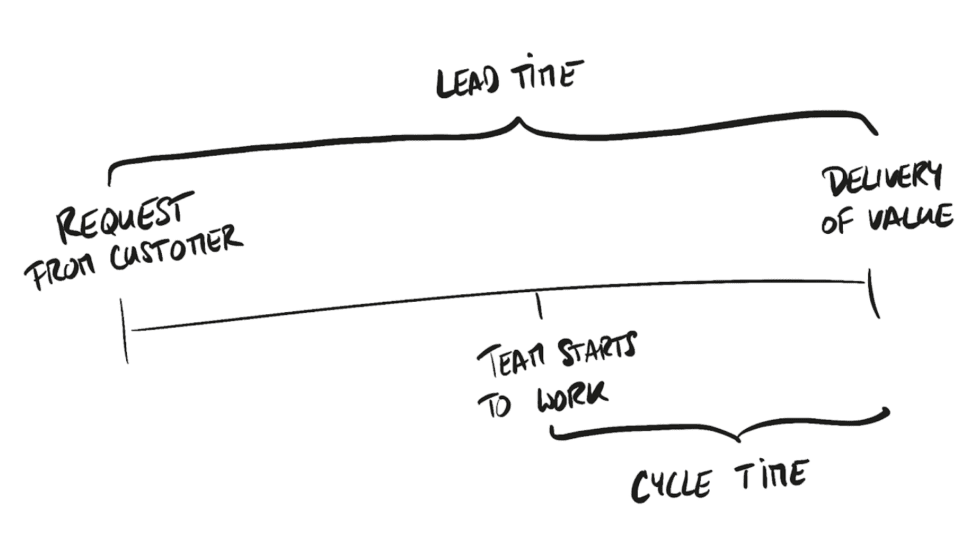

Simulation lead time refers to the period from the moment the program or design engineer requests a certain simulation to the time they receive the simulation results. It is distinct from simulation cycle time, which represents the time it takes the simulation team to start to work on the request to deliver it. The difference is the time between the moment the request is made and the time the team starts working on it.

During this time, engineers would always seek to simulate as many design variants as necessary to maximize the quality of the RFQ response. However, due to the nature of centralized simulation functions running one iteration at a time, the simulation lead time only allows for a limited number of iterations. This hinders the central simulation team from providing sufficient data within a shrinking timeframe, and, more crucially, it hampers the program engineers from delivering the optimal design to the customer. This limitation may lead to a knock-on effect, which could end up in falling short of a customer’s expectations, losing that customer, failing to meet the growing demand, and eventually, missing on revenue and market share. While this latent bottleneck is impeding the growth and innovation of certain teams, others have already found a practical way that completely resolves this bottleneck.

The Solution: Decentralized, Cloud-Native Simulation

Conventional, centralized simulation has been the norm for decades in the automotive industry, and it has been fairly successful when a simulation expert has the time to run their simulations in order to validate a single design variant. However, you and I know by now that’s not where the reality is today. Timelines are shrinking, and customer demand is growing. This is where a cloud-native simulation deployment strategy becomes an ideal solution helping engineering teams to innovate faster.

By leveraging the power of cloud computing, cloud-native simulation facilitates the decentralized use of simulation across the enterprise while keeping simulation quality control central with the simulation experts. It frees simulation from the limitations of local hardware, transforming engineering simulation from being a mere validation step at the end of the design cycle to underpinning the whole design cycle. This enables design and program engineers to simulate early and optimize their design faster and in real time, knowing that they are working with proven, robust methods that the simulation team has had more time developing. Furthermore, given there are no hardware limitations, simulations can be run in parallel at any scale, enabling design space exploration. This cuts the simulation lead time significantly. In fact, it eliminates the bottleneck altogether.

By decentralizing simulation processes across different teams while maintaining central simulation governance, automotive suppliers can empower design engineers to iterate rapidly. This approach fosters simulation-driven design, enabling teams to make informed decisions throughout the design cycle and significantly reducing simulation lead time. SimScale offers a next-generation simulation platform addressing these challenges by enabling early and intensive simulation adoption, thus reducing simulation lead times down from weeks to a single day without compromising quality.

Whitepaper: Real-Time Automotive Design & Simulation in the Cloud

Learn more about how you can optimize your automotive design process with SimScale and get industry insights for free.

Simulation-Driven Design Empowering Automotive Suppliers

The automotive industry is in a fuzzy transition period, driven by the imperative to innovate faster and more efficiently. Embracing cloud-native simulation deployment would be an easy solution to a complicated problem, especially for automotive suppliers seeking to thrive in this dynamic space.

By minimizing simulation lead time and embracing a culture of simulation-driven design, suppliers can unlock new realms of innovation and maintain a strong presence in this competitive market.

If you’re interested in learning more about cloud-native simulation, get in touch with us, request a consultation below, or simply sign up and try it for yourself. It works online in your web browser – no installation required, no hardware limitations. Also, check out our blog post on The Automotive Race to Innovation & Efficiency.

References

- Tominaga, K. et al. (2023). As Automakers Transform, So Must Suppliers. BCG. https://www.bcg.com/publications/2023/growth-strategy-tier-one-suppliers-auto-industry

- Diamante, O. S. (2023). A new dawn for hydrogen mobility in Europe. Petron Plaza. https://www.petrolplaza.com/news/32614

- Parkes, R. (2024). Ten years in the making | GM and Honda begin mass production of hydrogen fuel cells at Michigan factory. Hydrogen Insight. https://www.hydrogeninsight.com/transport/ten-years-in-the-making-gm-and-honda-begin-mass-production-of-hydrogen-fuel-cells-at-michigan-factory/2-1-1588982

- Shepardson, D. (2024). US to soften tailpipe rules, slow EV transition through 2030. Reuters. https://www.reuters.com/business/autos-transportation/biden-administration-relax-ev-rule-tailpipe-emissions-ny-times-2024-02-18/